If you own a property in Delhi, paying your MCD Property Tax isn’t just a civic duty it’s key to protecting your property rights. The Municipal Corporation of Delhi (MCD) collects this tax to fund city infrastructure, public amenities, sanitation, and development projects.

In this complete guide, we’ll walk you through how to pay MCD property tax online, understand the latest rates, exemptions, rebates, and schemes for 2026, and even learn how to download your property tax receipt without hassle.

Let’s dive in !

The Municipal Corporation of Delhi (MCD) imposes property tax on all types of properties residential, commercial, and vacant land within its jurisdiction.

These taxes support essential civic services like:

Paying your property tax ensures your property records stay updated and helps you avoid penalties or legal issues down the line.

MCD uses the Unit Area System (UAS) to calculate property tax. Under this method, tax is based on:

The category of your colony (A to H).

Property Tax = Unit Area Value×Area (sq.m) × Usage Factor×Age Factor×Occupancy Factor×Tax Rate

|

Category |

Description |

Example Areas |

Value Per Unit Area (₹/sq. m) |

|

A |

Most posh |

Vasant Vihar, Greater Kailash |

630 |

|

B |

Premium |

Defence Colony, Hauz Khas |

500 |

|

C |

Upper middle-class |

Janakpuri, Patel Nagar |

400 |

|

D |

Middle-class |

Rajouri Garden, Lajpat Nagar |

320 |

|

E |

Lower middle- class |

Uttam Nagar, Rohini |

270 |

|

F |

Economical |

Dwarka, Shalimar Bagh |

230 |

|

G |

Semi-urban |

Karol Bagh, Loni Road |

200 |

|

H |

Rural areas |

Narela, Najafgarh |

100 |

|

Property Type |

Category |

Tax Rate |

|

Residential |

A–H |

12% of Annual Value |

|

Commercial |

A–H |

20% of Annual Value |

|

Industrial |

A–H |

15% of Annual Value |

|

Vacant Land |

A–H |

10% of Annual Value |

Pro Tip: Mark your calendar every year for early payment the 15% rebate can make a big difference over time!

Great news for property owners who’ve fallen behind on payments !

The MCD has launched the Sumpattikar Niptaan Yojana 2025, valid from June 1 to September 30, 2025.

Under this scheme:

This is a great opportunity to clear old dues and start fresh with a clean property record.

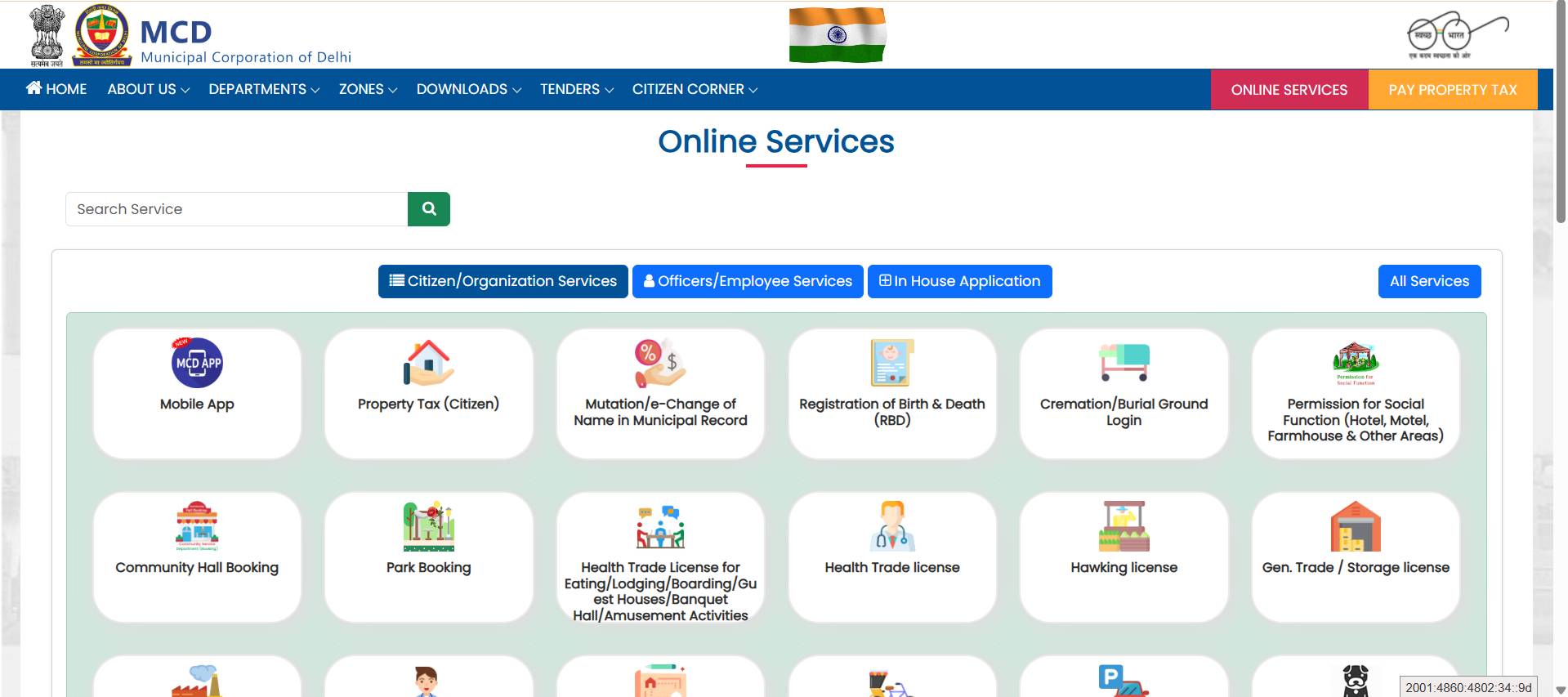

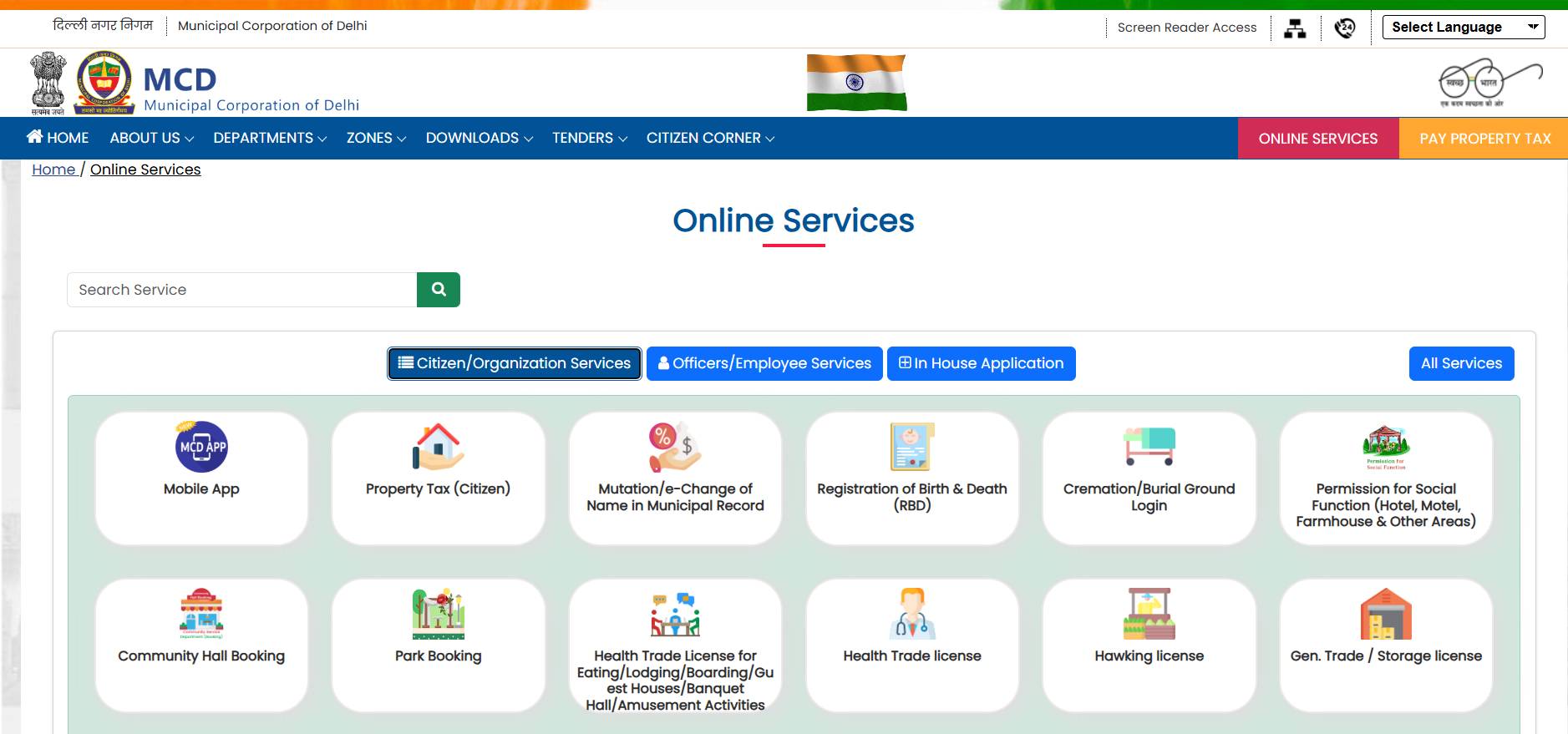

Paying your MCD property tax online is simple and convenient. Here’s a step-by-step walkthrough:

Step 1: Visit the Official MCD Website

Go to the MCD’s online property tax portal. Scroll down to find the “Online Services” section.

Step 2: Select ‘Property Tax’

Step 3: Enter Property Details

Step 4: Fill Property Information

Provide all required details property type, ownership, area, etc. The system automatically calculates your tax liability.

Step 5: Make Payment

Pay securely using credit/debit card, UPI, or net banking.

Step 6: Generate Challan

Once payment is successful, click on ‘Generate Challan’ to download the official MCD tax receipt.

Bonus Tip: The portal also shows any pending arrears, late fees, or penalties for transparency.

Prefer the old-school way ? No problem !

You can pay MCD property tax offline at authorized ITZ Cash Counters across Delhi.

After payment, you’ll immediately receive a receipt with your Property ID, which acts as proof of payment.

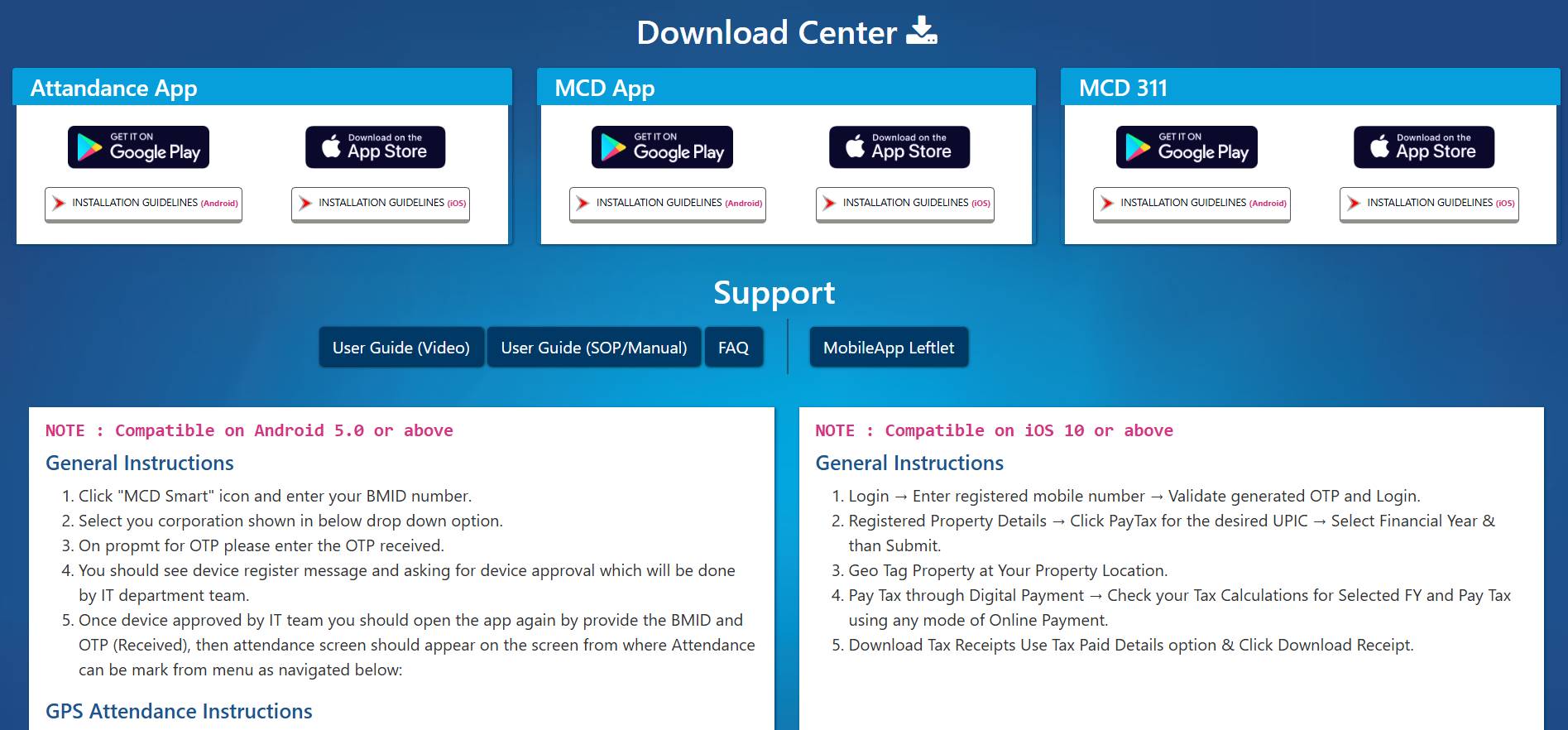

The MCD has made the process even easier with its Property Tax App, available on the Google Play Store.

Here’s how to use it:

Simple, paperless, and instant exactly how modern civic services should be !

If you don’t have your property ID:

Once found, you can link it with your user account for future payments.

MCD offers rebates to encourage early payments:

|

Rebate Type |

Description |

|

15% Rebate |

For full payment of tax before June 30 each year. |

|

Senior Citizens & Women |

Additional 10% concession for self-occupied residential properties. |

|

Ex-Servicemen & Physically Challenged |

Eligible for additional rebates as per MCD rules. |

If you fail to pay property tax by the due date:

Let’s say you own a 200 sq.m residential property in a Category C area (Patel Nagar).

Annual Value=9×200×1×0.9=₹1,620

Tax Payable=₹1,620×12%=₹194.4

|

Event |

Date |

|

Tax Payment Start |

April 1, 2025 |

|

15% Rebate Deadline |

June 30, 2025 |

|

Final Payment Due |

March 31, 2026 |

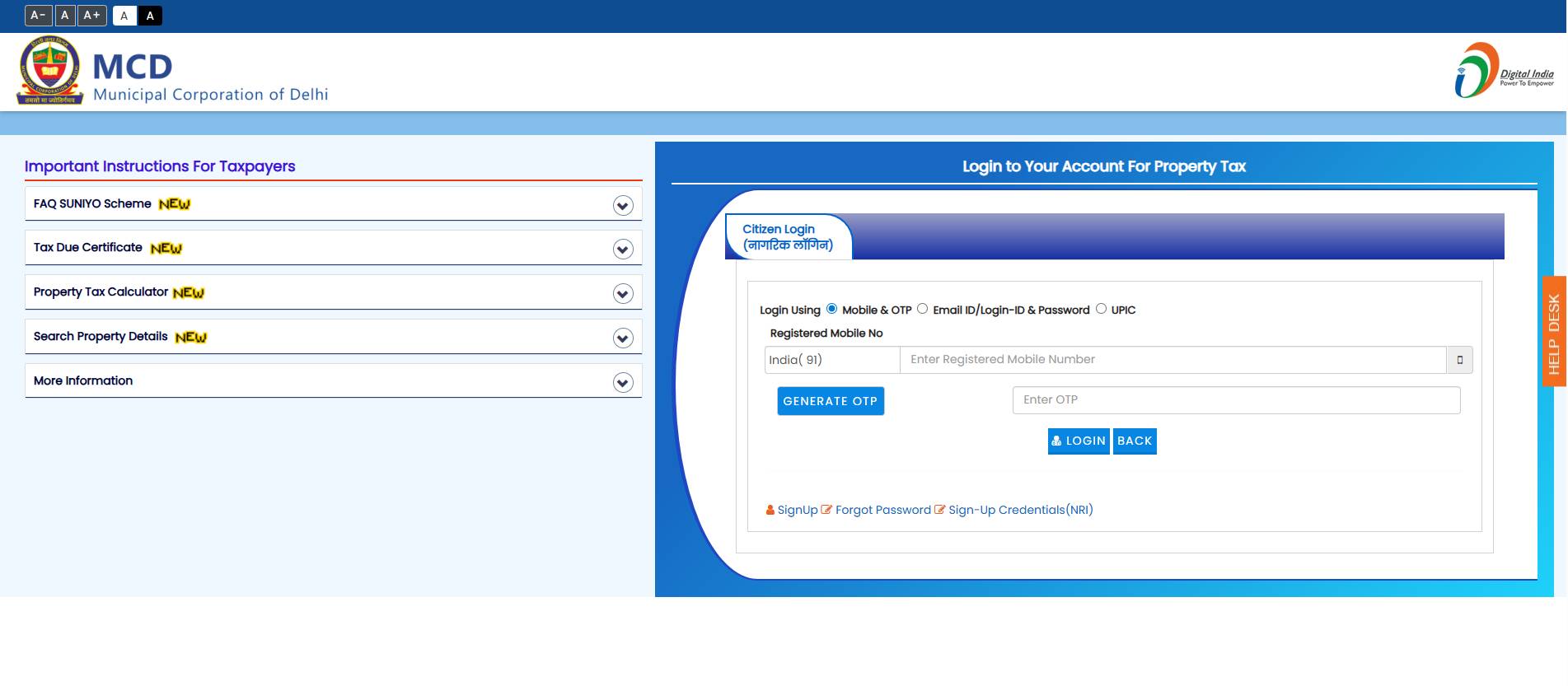

Need a copy of your payment receipt later? You can download it anytime from the MCD website.

Here’s how:

Log in using your registered mobile number.

Generate an OTP to verify your account.

Select your property’s region - South, North, East, or West Delhi.

Enter your property ID or address.

Preview and verify details.

Click Download Receipt to get a PDF copy.

Keep this handy for record-keeping, ITR filing, or proof of property tax compliance.

1. What is the last date to pay MCD property tax in Delhi ?

Ans: Usually March 31 of the financial year. Pay before June 30 to get a 15% rebate.

2. How can I check if my property tax is paid ?

Ans: Visit the MCD portal → “Property Tax → Check Payment Status” → Enter UPIC number.

3. Can I change my property details online ?

Ans: Yes, under the “Property Tax → Mutation” section on the MCD website.

4. What if I have multiple properties ?

Ans: You must pay tax separately for each property ID/UPIC.

5. Can tenants pay property tax ?

Ans: Usually, only the property owner is liable, unless otherwise agreed in the rental contract.

Conclusion

Paying MCD property tax in Delhi is now simple, transparent, and fully online. Whether you own a home, office, or plot, understanding the rates, calculation formula, and rebate schemes helps you save money and stay compliant.

By paying early through the MCD Online Portal, you can earn rebates, avoid penalties, and contribute to Delhi’s civic growth.

Disclaimer: This blog has been written exclusively for educational purposes. The information mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.